using their magazine background

STUDENT FINANCIAL MANAGEMENT

Thursday, May 19, 2016

Let's photograph

Design presentations, social media graphics,and more with thousands of beautiful layouts.

ABOUT ME

Assalamualaikum and Hai everyone...

First of all, i would like introduce my self

I’m Sharifah Nunzarina Binti Sayed Zulkafli. Studying in Universiti Utara Malaysia (A152 First Semester) in course Degree in Finance with Honours. My matric card number is 242721.

First of all, i would like introduce my self

I’m Sharifah Nunzarina Binti Sayed Zulkafli. Studying in Universiti Utara Malaysia (A152 First Semester) in course Degree in Finance with Honours. My matric card number is 242721.

beautiful view of Dewan Mas UUM.

3 INVESTMENT IDEAS FOR COLLEGE STUDENTS

Pay Yourself First – Start Investing

Open a brokerage account and start investing. Your goal should be to set aside ten percent of your net take home pay from your jobs or side businesses. Whether you’re mowing lawns or painting houses during your summer breaks or working at the mall, you can do this. By regularly investing a set amount you can build long term positions in stocks or stock funds that may appreciate over the long term.

For those who don’t want to fuss over investments, then you can buy a balanced low-cost mutual fund that’s split between stocks and bonds.

Clear View Wealth Advisors through its partnership with online brokerage custodian Betterment Institutional (www.Betterment.com) offers access to low balance accounts that can buy fractional shares of stocks and Exchange Traded Funds without any account minimums. Here accounts are invested based on a model tied to your age, goals and time period.

Alternately, you could be more active with your investments and do some day-trading. This takes more time but just like in school you’ll be rewarded for your diligence and homework if you hit it big.

Open an Online Money Market Account

Sock your money away in a money market account. Sure, current interest rates aren’t going to make you rich. But building a safe cash reserve will help you as you deal with college tuition, books and fees. And you’ll have money kicking around when a brilliant investment idea comes your way. While you can open an account at almost any bank, you may find the online options from companies like Discover offer a higher interest rate.

Consider Buying Life Insurance

Sure, you’re young and carefree. But anything can happen. And this is especially important if you have a spouse or dependents. It’s also important if you have or are planning on taking out student loans. If your parents co-sign for any of these loans, they’ll still be responsible if something happens to you. And conversely, you’ll still be on the hook on loans that they co-signed but you won’t have their income to help pay the loan if they’re gone. Consider getting a low-cost term insurance policy for the total of the loans you may be getting. Since student loans are typically written for a repayment period of ten or twenty years, you should consider an insurance policy with a term to match.

THE BEST SAVINGS ACCOUNT IN MALAYSIA

INTRODUCTION

As many of you are aware, I have a FIXED DEPOSIT PAGE to highlight the best Fixed Deposit Promotions currently being offered in town. However, all of us need a Savings Account and or Current Account too for daily transactions. Nowadays, some of us don't even have a Current Account (cheque books) because we can easily make all kinds of payment and or transfer fundsonline with our Savings Account. So I thought I might as well do and article to assist you guys to earn a few sen or maybe even a few hundred Ringgit by choosing the right Savings Account :)

Most of the time when I deposit my funds into Savings Accounts is because I need to park my money some place for 2 to 3 weeks. If we not using any of our funds for 1 month or more, then better to deposit into Fixed Deposit and earn better interest rates. Like I mentioned earlier, nowadays many people don't have cheque books, and with online accounts, we not only can transfer funds to other banks or make payments to Telco, Utility companies, Assessment; but, we can even transfer our funds from our Savings Account to an eFD with our Apple iPad or Android Tablets while we are shitting! So convenient. Doing Telephone Banking while shitting is not so appropriate lah as the other side can figure out what you are doing with the echo in the toilet, hahaha.

Generally, the highest interest rates for Commercial Banks' Savings Accounts are Children/Junior Savings Account. So, for those of you who have young children like me, we can use these Children Accounts to our benefit.

This time I am not going to give you guys a long introduction, so without further ado, let's go to the topic in hand.

THE BEST SAVINGS ACCOUNTS IN MALAYSIA

First off, I will present to you the table I have prepared. The accounts presented in my table was chosen with the following considerations:

For Junior/Kids Savings Account - interest rates close to 1 month FD rate.

For Adults' Savings Account - interest rate 2% or higher.

Below Table shows some of the best and highest Savings Accounts Interest Rates offered by Commercial Banks like AmBank, Hong Leong Bank, Maybank, Public Bank, OCBC Bank and Standard Chartered Bank.

Below Table shows some of the best and highest Savings Accounts Interest Rates offered by Commercial Banks like AmBank, Hong Leong Bank, Maybank, Public Bank, OCBC Bank and Standard Chartered Bank.

CHILDREN SAVINGS ACCOUNT

From the above table, first thing to note is when the interest is credited. The second criteria is what are the conditions for withdrawal. These two conditions are is extremely important. Why? Like I said in my introduction, the reason why I need a Savings Account is to park my funds for 2 to 3 weeks, for 1 month and above, better to go with Fixed Deposit.

So, with the first criteria of interest credited monthly, then you would have earned interest parked in the Savings Account for less than a month and get more to withdraw to deposit in FD or burn it away.

The second criteria of how many withdrawals are allowed is extremely crucial, if the account only allows you to withdraw once a month, if you did not plan properly and did a withdrawal and then you want to do another withdrawal and you can't, then it may be a problem for you.

It can be observed that AmGenius offering 3% interest rate p.a. credited monthly looks like it is the best. However, I cannot seems to find the Terms and Conditions at AmBank website on the 1 withdrawal a month thingy.

So, for me, I would go with interest credited monthly offered by either Hong Leong Bank Junior Savings Account or Public Bank Wise Savings Account. Both these accounts allow you to perform a withdrawal once a month without any penalty, i.e. you will earn the interest rate as quoted. You can do more than the allowable FREE withdrawals, just that you need to pay RM2 per withdrawal.

Now, if AmGenius do allow you more than 1 withdrawal but with a fee of RM2 or less without effecting the interest rate of 3% p.a., then it is better than the HLB and PBB kids savings accounts mentioned above :)

As for the OCBC Junior SmartSavers offering up to 3.1% interest rate credited monthly, I will discuss it below together with Smart Savers Account.

[Update September 2013 - NEW UOB Fun Savers Account for Children/Kids]

Previously last year when I wanted to open joint Fixed Deposit with my children in UOB, I had to seek UOB HQ for approval; and, my children had to sign numerous forms too.

This year UOB started to promote their children savings account called Fun Savers and the interest rate is pretty good at 2.9%. However, unlike Hong Leong Bank Junior Children Savings Account where interest is credited monthly, the UOB Fun Savers interested is credited twice yearly. Please also refer to the table I prepared earlier showing you the frequency of interest credited into bank's savings account.

SAVINGS ACCOUNT FOR ADULTS

Most savings accounts for adults pay miserable interest rates and are based on tiers. If you refer to the table I have prepared, you will note that I have emphasized on Maybank 2U Savers which is a pure online savings account. With these M2U Saver accounts, you are not issued a passbook and if you go to any Maybank Branch and perform over the counter transaction (e.g. withdrawing or depositing money), a fee of RM5 may (not necessary for huge deposits/withdrawals) be imposed!!! However, the M2U Savers account do offer interest rate of above 2% for amount more than RM2K which is among the best rates you can find for any savings account in Malaysia. This M2U Savers is like what is being offered in Australia where they give pretty highinterest rates for online Savings Account but will charge you fee if you perform any transactions at the counters.

So, if you you are not into current account and have more than RM2K at any one time in your present Savings Account - then it may be a good option to look into Maybank2U Savers Account:

Step 1 - Go to a Maybank Branch to open a Basic Savings Account that pays miserable interest rate (minimum amount RM20 must be maintained at all time to avoid maintenance charges, deposit lah like RM50) and at the same time apply for M2U (Maybank online banking which can only be opened at MBB branch) AND get Maybank Debit Card (where there is an annual fee of RM8 and that is why you must deposit more than RM20 when you open the account).

Now it gets complicated, the Maybank Basic Savings Account has two options:

Option 1 - annual fee of RM8. Unlimited FREE over the counter transactions and first 2 GIRO transactions in a month at a fee of RM0.50 per transaction and RM2.00 from the 3rd transaction onwards.

Option 2 - no annual fee. 6 over the counter visits and ONLY 8 free ATM cash withdrawals. No fee shall be imposed for non-cash withdrawal transactions (e.g. balance inquiry or fund transfer within Maybank). First 2 GIRO transactions in a month at a fee of RM0.50 per transaction and RM2.00 from the 3rd transaction onwards.

Choose Option 2. You will see why later.

Step 2 - Once you have M2U online account ONLY you can go open a Maybank2U Savers account to earn higher interest rates. Deposit all your money into this account and only transfer the amount of money you need to use to the Basic Savings Account :) Now, the Maybank 2U Savers account allows you unlimited FREE ATM withdrawals, That's why I said choose Option 2 above. Nowadays, we don't really need to do over the counter (OTC) transactions, but if you need to, you still get 6 FREE OTC visits with Option 2. The other thing is MBB website did not mentioned the fee structure for Maybank2U Savers account GIRO transactions; so, you better check it out. And you can always transfer your funds to the Basic Savings Account where the first 2 GIRO transactions only cost you RM0.50.

Above does looks like a lot of work, and I did say it is only worthwhile if you constantly have more than RM2K in your present Savings Account. Well, actually you need more than RM5K so that at least you can earn minimum interest of about RM5.25/month.

To tell you the truth, I have several Maybank Credit Cards but I don't have a single banking account with Maybank, hahaha. Above is just to point out to you Maybank's Savings Account especially on the Maybank2U Savers account high interest rates.

To learn more about the Maybank2U Savers account, please visit www.maybank2.com.my

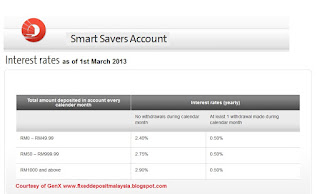

OCBC SmartSavers Account

I thought I highlight to you guys too OCBC Smart Savers Account where you get 3% (3.1% for Junior) interest credited monthly subjected that there is no withdrawal during the month. This account may be useful for those who need like less than 1 month period to park excess funds AND withdraw their funds early in the month only.

Minimum Initial Deposit: RM200 (New)

Maximum Balance: RM300,000

Minimum Account Balance: RM20

Interest rates are determined by the following two factors:

• Total cumulative deposits amount made by the customer into their SmartSavers Account

every calendar month; and

• Any withdrawals from the SmartSavers Account made every calendar month.

• The interest you earn is also subjected to amount deposited into the Smart Savers Account monthly. From the above table. Deposit less than RM49.99 you will earn 2.5%, deposit RM50-RM999 you will earn 2.85% and deposit above RM3K will earn you interest rate of 3%. Of course this is subjected that you do not make any withdrawals in that particular month.

The best thing about OCBC Smart Savers is that you don't deposit a sen also you earn 2.5% interest rate pa. But if you do a withdrawal, the interest rate for the calendar month becomes 0.5%; therefore, if you want to do any withdrawal to transfer your money into FD, best to do it early in the month. But I kind of like this, say I have a FD maturing middle of the month and I only need to use this fund on the 1st of next month, I can then park this FD money into OCBC SmartSavers account and earn 3% p.a. interest rate for 2 weeks :)

The OCBC SmartSavers Account does not come with a Passbook and you can only do withdrawals over the counter at the branch. Interest is credited monthly and a monthly statement will be sent to you. Actually, I prefer monthly statement instead of Passbook which needs me to go to the branch and get it updated so that I can see the monthly interest earned.

Update - Below is the Smart Savers Interest Rates as of 1st March 2013

UOB eAccount Savings Account (added September 2013)

Effective June 2013, UOB has revised the interest rate for this account to be more competitive. It now pays 2.68% pa interest rate if you have RM15K and above in the account.

OCBC Starter Savings Account - Initial Deposit RM4K. Interest up to 2.9%

Minimum Initial Deposit: RM200 (New)

Maximum Balance: RM300,000

Minimum Account Balance: RM20

Interest rates are determined by the following two factors:

• Total cumulative deposits amount made by the customer into their SmartSavers Account

every calendar month; and

• Any withdrawals from the SmartSavers Account made every calendar month.

• The interest you earn is also subjected to amount deposited into the Smart Savers Account monthly. From the above table. Deposit less than RM49.99 you will earn 2.5%, deposit RM50-RM999 you will earn 2.85% and deposit above RM3K will earn you interest rate of 3%. Of course this is subjected that you do not make any withdrawals in that particular month.

The best thing about OCBC Smart Savers is that you don't deposit a sen also you earn 2.5% interest rate pa. But if you do a withdrawal, the interest rate for the calendar month becomes 0.5%; therefore, if you want to do any withdrawal to transfer your money into FD, best to do it early in the month. But I kind of like this, say I have a FD maturing middle of the month and I only need to use this fund on the 1st of next month, I can then park this FD money into OCBC SmartSavers account and earn 3% p.a. interest rate for 2 weeks :)

The OCBC SmartSavers Account does not come with a Passbook and you can only do withdrawals over the counter at the branch. Interest is credited monthly and a monthly statement will be sent to you. Actually, I prefer monthly statement instead of Passbook which needs me to go to the branch and get it updated so that I can see the monthly interest earned.

Update - Below is the Smart Savers Interest Rates as of 1st March 2013

UOB eAccount Savings Account (added September 2013)

Effective June 2013, UOB has revised the interest rate for this account to be more competitive. It now pays 2.68% pa interest rate if you have RM15K and above in the account.

OCBC Starter Savings Account - Initial Deposit RM4K. Interest up to 2.9%

For those of you who do save monthly for long term, check out OCBC Starter Savings Account where you need to deposit monthly or else you will only earn interest rate of 0.5% as compared the OCBC SmartSaver plan of 2.5%. However, the good thing about this Savings account is that if you do one or more withdrawals, you get higher interest rates compared to SmartSavers.

PREMIER BANKING SAVINGS ACCOUNT

If you want high interest rate for your Savings Account similar to that of Fixed Deposit rates, go check out OCBC Premier Savings Account where it pays 3%. No conditions like you need to deposit monthly like the OCBC Smart Savers Account to earn high interest rate. And you are not penalized if you were to make any withdrawal.

PREMIER BANKING SAVINGS ACCOUNT

If you want high interest rate for your Savings Account similar to that of Fixed Deposit rates, go check out OCBC Premier Savings Account where it pays 3%. No conditions like you need to deposit monthly like the OCBC Smart Savers Account to earn high interest rate. And you are not penalized if you were to make any withdrawal.

CONCLUSION - Savings Account for GenZ, GenY, GenZ and Beyond.

Everybody got their own strategies on how to maximize their hard earn money. In my opinion, for long term savings, it does not makes sense to park your money in a Savings Account when you can go open a Fixed Deposit Account with RM500 for tenure of 2 months and above and earn more. However, most of us do have money in Savings Account for emergency use or for our daily expenses.

And once again to those of you who find this article interesting or maybe not and want to criticize it, please do not cut and paste "my work" into your website/blog or steal my contents and claim it to be yours; I would appreciate if you can please provide link to this article instead and I hereby thank you for your kind understanding and unselfish cooperation.

And once again to those of you who find this article interesting or maybe not and want to criticize it, please do not cut and paste "my work" into your website/blog or steal my contents and claim it to be yours; I would appreciate if you can please provide link to this article instead and I hereby thank you for your kind understanding and unselfish cooperation.

Savings Account For Adults without Children

Well, for you guys, you don't have many products to consider since most Savings Accounts pays miserable interest rates except for Maybank2U Savers, OCBC SmartSavers and OCBC Starter Savings Account. But then again, if you have like RM500, you can always go open Fixed Deposit with tenure of 2 months and above to earn more money. And if you have more RM20K in your savings, then go check out my FIXED DEPOSIT PAGE for highest interest rates in town.

Having said that, the OCBC Starter Savings is really good, just deposit RM1 every month and don't do any withdrawal and you will earn interest rate of 2.5% p.a. for the entire amount in the account.

Savings Account for Parents

Like I mentioned, for those who have kids, why settle for basic savings account when we can earn more with junior accounts. Those of you who have kids should take advantage Hong Leong Bank Junior FD and Junior Savings Account. You see, most of the time HLB offers better interest rates for Junior Fixed Deposit compared to other FD promotions. For example, HLB Junior FD was offering 5% and 4.5% for tenures up to 2 to 5 years back in October 2010 and 2011 respectively. And best of all, HLB Junior FD pays interest monthly where it is credited into HLB Junior Savings Account which the interest is also paid monthly.

And nowadays, there are HLB branches everywhere. For my case, my children have their own Junior FD and Savings Account in one branch; and, I would go to another branch to open another Junior FD and Savings Account for my own use. However sometimes I would split my deposits into my "children's account" too because once you hit RM50K, the interest paid drops like hell. And when I do deposit into my "children's Junior Account", I would only withdraw out the principal and whatever interest earned is theirs. Not only that, you can go to any HLB branch and do withdrawals from your Junior Savings Account and there's no limit for inter-branch cash withdrawals.

Savings Account for Grandparents

And for Grandparents, if you have HLB Senior Fixed Deposit and Savings Account, you should consider opening an account with your grandchild. As you are well aware, the HLB Senior FD also credit the interest monthly into a Senior Savings Account, so you may ask why go open Junior Account? Because, HLB Junior FD for the past 3 years always offer higher interest rate compared to Senior FD. Don't believe, me, go check it out yourself the next time you go to HLB (or maybe my FD Page may even show the current HLB Promos). And, the interest rate for HLB Senior Savings Account is pathetic.

However, in order to open a Junior Account, you need to bring along your son's and grandchild's birth certificate to proof the relationship when opening the Junior Accounts. Another thing, if the account is joint name with your son and either one can sign, I guess you need to trust your son 101% because you may hold the Passbook but your son can transfer your money out with his HLB online account!!! Then again, it also makes it easy to transfer out the money when you go to heaven. I got no idea if you can open a HLB Junior Account with your daughter's child; then again, why would you want to do that since she's already married out of the family and the grandchild "belongs" to the other family, hahahahaha.

And last but not least, The Best Savings Account For Kids is Hong Leong Bank Junior Savings Account because the kid will get his own Visa Debit Card. This will enable the kid to go buy apps for his/her Apple iPod, iPad and iPhone :) My GenZ daughter had her own Visa Debit card from HLB when she was 10 years old to buy ebook online and Apps for her Apple iPad (the first model) and now she's has her own Apple iPod nano (serve as a watch), iPod Touch and the new iPad.

You see, unlike Public Bank Debit Card where kids with NRIC are only allowed to apply for it and takes weeks for it to be approved and delivered; the HLB Debit Card is issued on the spot.

When getting the HLB Debit card, make sure you do not allow for auto top up from the Junior Savings Account. Treat it like a Prepaid card where you have to manually go deposit money into the Debit Card account (not the Junior Savings Account) at the Cash Deposit Machine. I don't deposit money into her HLB Junior Debit Card accout, she has to use her pocket money or Ang Pow money. So she has to control her spending and think twice before making a purchase. But my youngest daughter is more stingy than me 10X. The only time she really wasted money was when she bought a RM600 ear phone (with her own money) to use with her Apple gadgets whereas I only use the free ear phones that comes with my gadgets. I tell you, I think the people who walks around in town with huge ear phones on their heads makes them look kind of odd. But then again, what does GenX like me knows about GenY and GenZ fashion sense.

However, it order to do online transactions with HLB Junior Debit Card, the parent first have to sign up for HLB online account! To learn more about Debit Cards for kids, please click here to read my article Parents Children iTunes at Ringgit Wise Fool where I even listed step by step on how to set up allowing online transaction for HLB Junior Debit Card.

And last but not least, DO NOT ever click on email links with banks name. Best is to create a email address just for banks and this address is not disclosed to anyone else. Always key in the bank website address yourself to log in.

And last but not least, The Best Savings Account For Kids is Hong Leong Bank Junior Savings Account because the kid will get his own Visa Debit Card. This will enable the kid to go buy apps for his/her Apple iPod, iPad and iPhone :) My GenZ daughter had her own Visa Debit card from HLB when she was 10 years old to buy ebook online and Apps for her Apple iPad (the first model) and now she's has her own Apple iPod nano (serve as a watch), iPod Touch and the new iPad.

You see, unlike Public Bank Debit Card where kids with NRIC are only allowed to apply for it and takes weeks for it to be approved and delivered; the HLB Debit Card is issued on the spot.

When getting the HLB Debit card, make sure you do not allow for auto top up from the Junior Savings Account. Treat it like a Prepaid card where you have to manually go deposit money into the Debit Card account (not the Junior Savings Account) at the Cash Deposit Machine. I don't deposit money into her HLB Junior Debit Card accout, she has to use her pocket money or Ang Pow money. So she has to control her spending and think twice before making a purchase. But my youngest daughter is more stingy than me 10X. The only time she really wasted money was when she bought a RM600 ear phone (with her own money) to use with her Apple gadgets whereas I only use the free ear phones that comes with my gadgets. I tell you, I think the people who walks around in town with huge ear phones on their heads makes them look kind of odd. But then again, what does GenX like me knows about GenY and GenZ fashion sense.

However, it order to do online transactions with HLB Junior Debit Card, the parent first have to sign up for HLB online account! To learn more about Debit Cards for kids, please click here to read my article Parents Children iTunes at Ringgit Wise Fool where I even listed step by step on how to set up allowing online transaction for HLB Junior Debit Card.

And last but not least, DO NOT ever click on email links with banks name. Best is to create a email address just for banks and this address is not disclosed to anyone else. Always key in the bank website address yourself to log in.

Tuesday, May 17, 2016

HOW TO SAVE MONEY THE RIGHT WAY

1. Make A Financial Budget Plan

It is always important to determine how much you are spending from time to time. Maintain a separate journal with you to keep a track of all that you spend daily, weekly and monthly, because this will allow you to be more financially aware and savvy. Consequently, you will know how much more you need for your expenses or how much you need to hold back for other basic necessities such as food and clothing. This method has proven to be effective, especially when it helps you save your parent’s hard-earned investment for something more useful like your college funds.

2. Malaysia Student Discount Card

This card is free and truly lives up to its title. Malaysian students can use this to save up to 60 percent of what they spend on retail stores. It is easily made available to college students from all over the country.

By using this card, students are able to save up on textbooks, learning material, food, transportation and products from retail stores. Students may also find that most discount prices range between 5-15 percent and are already set up for anyone with a proper Student ID.

3. Prioritize The 10 Percent Rule

Unless you are doing some kind of part time job, you are basically living off of your parents’ investment in the form of an allowance. The money that you get from them is not for your amusement or unrelenting spending spree, it is a part of their trust in you. If you don’t want to hurt your parents’ pride and trust, you will have to be more firm and restrictive of where you throw that money at. This is why it is advisable for you to adopt a 10 percent saving method, which means if you get a monthly allowance of RM 400, you have to save up to RM 40 for emergency situations. Aside from allowances, this rule additionally applies to PTPTN and MARA loans as well as scholarships.

4. Discounts For Conveyance

This step is targeted to those students who dwell in the Klang or the Selangor valley. All they have to do is to sign up for Rapidpass Pelajar Integrasi which costs about RM100 a month for bus, monorail and LRT, or a Rapidpass Pelajar Bas pass which is RM 50 monthly for bus services. These services are guaranteed to give students as much transportation as they need for a month.

KTM tosses a 50% discount for those students who wish to travel all over peninsular Malaysia. If all else fails, then you might want to resort to carpooling your friends’ rides and split the fuel money.

5. Start Investing

Don’t be a spendthrift or a person whose role is basically all about spending and start investing. Not only will you be saving on money but you will be earning some as well which will be your own income. You will be able to earn a good sum of interest following your commitment to investment. Be sure to read up various financial magazines, annual and financial reports to be more aware of the risks involved before you even try to opt for a suitable area to invest in.

6. Be Careful Of Your Credit Card

According to reports constructed by Department of Statistics, about 50 percent Malaysians under the age of 30, which most prominently indicate the college attending population, are declared bankrupt. If there is one thing that you cannot afford is being accounted for the many number of expenses that go beyond your budget. Be careful not to mishandle your credit card and use it only when the situation is most dire.

7. Using The Resources Of Your Institution

You will find that colleges offer resources and activities that provide a great means to save money. A conspicuous example would be that of your colleges very own internet connection. No matter how much time you spend on research or, at some point, mindless browsing, the cost of all that surfing and browsing will be borne by the university, and not the students themselves.

It is always important to determine how much you are spending from time to time. Maintain a separate journal with you to keep a track of all that you spend daily, weekly and monthly, because this will allow you to be more financially aware and savvy. Consequently, you will know how much more you need for your expenses or how much you need to hold back for other basic necessities such as food and clothing. This method has proven to be effective, especially when it helps you save your parent’s hard-earned investment for something more useful like your college funds.

2. Malaysia Student Discount Card

This card is free and truly lives up to its title. Malaysian students can use this to save up to 60 percent of what they spend on retail stores. It is easily made available to college students from all over the country.

By using this card, students are able to save up on textbooks, learning material, food, transportation and products from retail stores. Students may also find that most discount prices range between 5-15 percent and are already set up for anyone with a proper Student ID.

3. Prioritize The 10 Percent Rule

Unless you are doing some kind of part time job, you are basically living off of your parents’ investment in the form of an allowance. The money that you get from them is not for your amusement or unrelenting spending spree, it is a part of their trust in you. If you don’t want to hurt your parents’ pride and trust, you will have to be more firm and restrictive of where you throw that money at. This is why it is advisable for you to adopt a 10 percent saving method, which means if you get a monthly allowance of RM 400, you have to save up to RM 40 for emergency situations. Aside from allowances, this rule additionally applies to PTPTN and MARA loans as well as scholarships.

4. Discounts For Conveyance

This step is targeted to those students who dwell in the Klang or the Selangor valley. All they have to do is to sign up for Rapidpass Pelajar Integrasi which costs about RM100 a month for bus, monorail and LRT, or a Rapidpass Pelajar Bas pass which is RM 50 monthly for bus services. These services are guaranteed to give students as much transportation as they need for a month.

KTM tosses a 50% discount for those students who wish to travel all over peninsular Malaysia. If all else fails, then you might want to resort to carpooling your friends’ rides and split the fuel money.

5. Start Investing

Don’t be a spendthrift or a person whose role is basically all about spending and start investing. Not only will you be saving on money but you will be earning some as well which will be your own income. You will be able to earn a good sum of interest following your commitment to investment. Be sure to read up various financial magazines, annual and financial reports to be more aware of the risks involved before you even try to opt for a suitable area to invest in.

6. Be Careful Of Your Credit Card

According to reports constructed by Department of Statistics, about 50 percent Malaysians under the age of 30, which most prominently indicate the college attending population, are declared bankrupt. If there is one thing that you cannot afford is being accounted for the many number of expenses that go beyond your budget. Be careful not to mishandle your credit card and use it only when the situation is most dire.

7. Using The Resources Of Your Institution

You will find that colleges offer resources and activities that provide a great means to save money. A conspicuous example would be that of your colleges very own internet connection. No matter how much time you spend on research or, at some point, mindless browsing, the cost of all that surfing and browsing will be borne by the university, and not the students themselves.

HOW TO CREATE YOUR BUDGET

Budgeting is an important component of financial success. It's not difficult to implement, and it's not just for people with limited funds. Budgeting makes it easier for people with incomes and expenses of all sizes to make conscious decisions about how they'd prefer to allocate their money.

Cashflow In

+ Income- Are you working while in school? Donating plasma? Painting houses? Have you landed a cushy paid internship? Plan out what you will make, after taxes, weekly, and UNDER-estimate what you will have at the end of the semester. While you may work extra shifts or pick up some overtime, more than likely you will be taking time off to study or go on trips.

+ Allowance- Do you have any scholarships? Are your family members sending you money? Look at those dollar amounts as “donations” and include them here. Scholarships can be rescinded or reduced for a number of extenuating circumstances, and so can gifts from mom and dad.

+ Loans- Keep this as a separate column, because you know better than anyone that you will have to pay this back, with interest. Always know, your creditors are watching you.

Cashflow Out

- Tuition– This gets you in the door. You will know this number at the beginning of every semester. If you pay in installments, put that down as well.

- Rent- Depending on your university’s location, rent can be where you can save a bundle or hemorrhage cash. Don’t be afraid to live in a small space with lots of roommates, the library is free to study in, and you will never see anything for that college rent money except the memories you make.

- Groceries- Learn where the deals are, get a membership to Sam’s Club or Costco, and eat as healthy as you can. Your future clothing budget will thank you, trust me.

- Social Budget (Necessary)- You need to make friends and go out during college. Your network of friends will serve you out in the real world, and you should be building those relationships. Plan for one big trip per semester, and a few nights out a week. If you don’t take that trip, you can use that money to do something else. BONUS!

- Social Budget (Slush Fund)- This is for any incidental social spending. Make a pledge to yourself that you will plan out this number when sober, and DO NOT SPEND MORE THAN YOU ALLOT TO THIS CATEGORY. Sometimes a party requires a costume, or you need tickets to concert that wasn’t scheduled until last week. Plan ahead for that.

- Books and supplies- Books are very expensive, and sometimes not found on Amazon or online bookstores. Leave some room for a few $100 books in your book budget. For art, architecture, and engineering students, special supplies are required for your classes. Some are expensive one-time purchases, some add up over time. Be aware, and read your syllabi as soon as they are available.

- Emergency- Things will go wrong. Have an emergency budget set aside, and carry it over to the next semester if you don’t use it. DO NOT spend this on a finals week party, you may find out you need something at the last minute.

- Transportation- Know the transportation deals around campus, whether they are free buses, safe rides, or bikeshares. If you are in a city and have a monthly bus pass, put those charges here.

- Getting home- See if there are any deals on how to get back home. Book tickets in advance, since everyone goes home at the same time, and don’t be afraid to carpool. Gas money split four ways is much cheaper than bus, train, or plane tickets.

- Car- If you have a car at school, put money aside to upkeep it. Oil changes, car washes, gas, and the occasional broken window or side view mirror. All of these things are common on a college campus. Plan ahead.

- Miscellaneous- Some people like spending money for a nice haircut. Some people need ten hooded sweatshirts with their university’s name on it. Think ahead, take inventory of your habits, and put money away in here for them.

Monday, May 16, 2016

FINANCIAL PROBLEM AMONG STUDENTS

food price causes the financial problem

Almost all university students opt to take food at outside such as fast food (PIZZA HUT, KFC, MCD) and restaurants, because food in their cafeteria not worth it. food in cafeteria tend to be expensive and don't have quality. Food poisoning are common among students in these day as the cafeteria does't emphasize cleanliness. beside that, student are not allowed to cook in their hostel, so they rather buy food from outside even though it's more expensive.

college fee causes financial problem

as a university student, we have to faced many problem. One of the most common problem is difficulty in paying college fees. Some of the students did not get any loan or scholarship, so they have to depend on their they parents. For those who came from poor background they are forced to work to gain extra money to pay their fee. For students who are not able to balance between work and academic, this will definitely effect their studies. it will eventually cause their CGPA to drop and for more serious cases being expel from university.

Subscribe to:

Comments (Atom)